Semiconductor Shipments Forecast to Exceed 1 Trillion Devices in 2018

Semiconductor units forecast to increase 9% with IC units rising 11%, O-S-D units growing 8%.

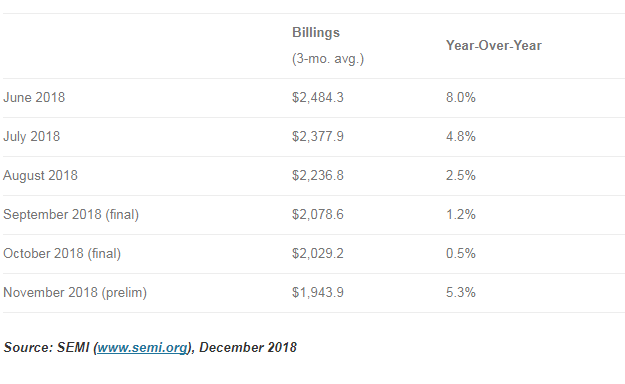

Annual semiconductor unit shipments (integrated circuits and opto-sensor-discretes, or O-S-D, devices) are expected to grow 9% in 2018 and top one trillion units for the first time, based on data presented in the new, 2018 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (Figure 1). For 2018, semiconductor unit shipments are forecast to climb to 1,075.1 billion, which equates to 9% growth for the year. Starting in 1978 with 32.6 billion units and going through 2018, the compound annual growth rate for semiconductor units is forecast to be 9.1%, a solid growth figure over the 40 year span.

Figure 1

Over the span of just four years (2004-2007), semiconductor shipments broke through the 400-, 500-, and 600-billion unit levels before the global financial meltdown caused a big decline in semiconductor unit shipments in 2008 and 2009. Unit growth rebounded sharply with 25% growth in 2010 and displayed another strong increase in 2017 (14% growth) to climb past the 900-billion level.

The largest annual increase in semiconductor unit growth during the timespan shown was 34% in 1984, and the biggest decline was 19% in 2001 following the dot-com bust. The global financial meltdown and ensuing recession caused semiconductor shipments to fall in both 2008 and 2009; the only time that the industry experienced consecutive years in which unit shipments declined. The 25% increase in 2010 was the second-highest growth rate across the time span.

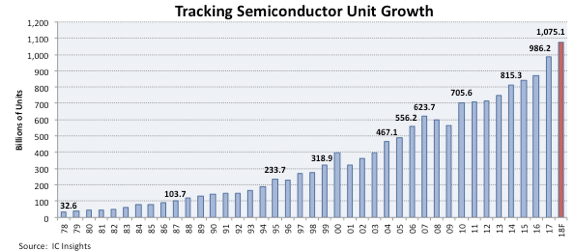

The percentage split of total semiconductor shipments is forecast to remain weighted toward O-S-D devices. In 2018, O-S-D devices are forecast to account for 70% of total semiconductor units compared to 30% for ICs. Thirty-eight years ago in 1980, O-S-D devices accounted for 78% of semiconductor units and ICs represented 22% (Figure 2).

Figure 2

Semiconductor products forecast to have the strongest unit growth rates in 2018 are those that are essential building-block components in smartphones, automotive electronics systems, and within systems that are helping to build out of Internet of Things. Some of the fast-growing IC unit categories for 2018 include Industrial/Other—Application-Specific Analog (26% increase); Consumer—Special Purpose Logic (22% growth); Industrial/Other—Special Purpose Logic, (22%); 32-bit MCUs (21%); Wireless Communication—Application-Specific Analog (18%); and Auto—Application-Specific Analog (17%). Among O-S-D devices, CCDs and CMOS image sensors, laser transmitters, and every type of sensor product (magnetic, acceleration and yaw, pressure, and other sensors) are expected to enjoy double-digit unit growth this year.

Report Details: The 2018 McClean Report

Additional details on IC and semiconductor unit and market trends are provided in the 2018 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Reportincludes free monthly updates from March through November (including a 250+ page Mid-Year Update), and freeaccess to subscriber-only webinars throughout the year. An individual-user license to the 2018 edition of The McClean Report is priced at $4,290 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,290.

在线留言询价

$62.7B semiconductor equipment forecast: Top previous record, Korea at top but China closes the gap

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: