- Ameya360 Component Supply Platform >

- Trade news >

- Semiconductor Equipment Sales Back on the Rise

Semiconductor Equipment Sales Back on the Rise

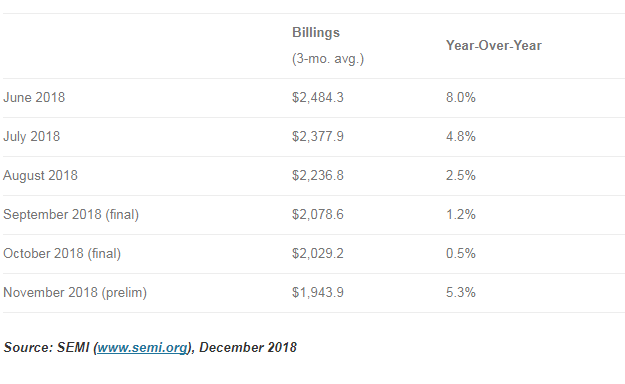

Sales by North American semiconductor equipment manufacturers increased in November compared with October, the first month of sequential increase in five months, according to the SEMI trade association.

The three-month average of billings by North American tool makers rose by 1.6 percent from October, reaching $2.05 billion, SEMI said. November billings were 27.2 percent higher than November 2016, the organization said.

SEMI's Japanese counterpart, the Semiconductor Equipment Association of Japan, reported that November billings for Japanese semiconductor equipment totaled about $1.54 billion, a decrease of less than 1 percent from October but an increase of 21.1 percent from November 2016.

The semiconductor equipment industry remains firmly on track to post record sales in 2017. SEMI last week raised its forecast for full-year sales to a record $55.9 billion,which would represent an increase of 35.6 percent from last year.

"Year-to-date equipment spending is well on track to set a historical high, and we expect that positive momentum to continue into next year as new fabs in China begin to equip," said Dan Tracy, SEMI's senior director of industry research and statistics, in a statement.

Online messageinquiry

$62.7B semiconductor equipment forecast: Top previous record, Korea at top but China closes the gap

Semiconductor Equipment Sales Rise Again

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: